Maximize Your Crypto Tax Returns

with our secure, Australian-made software!

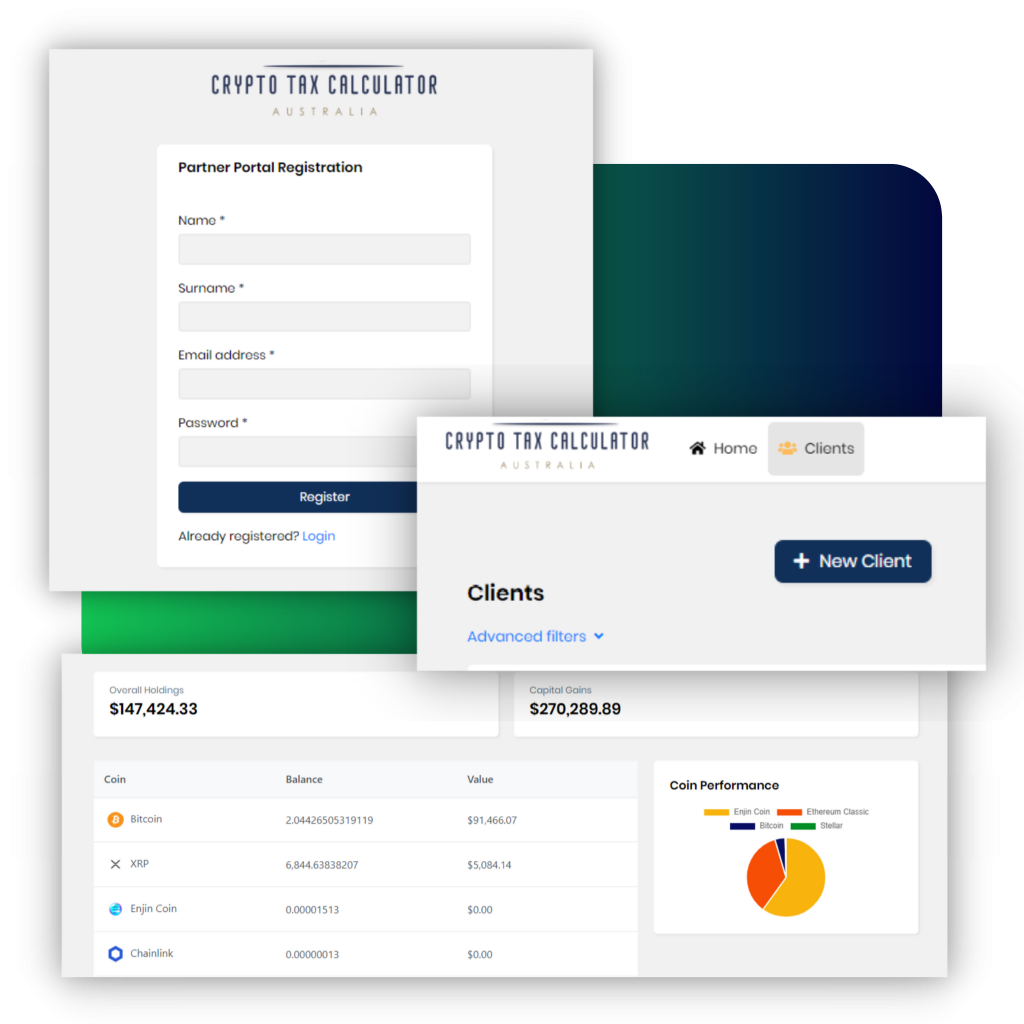

We are here to support all accountants Australia wide with any clients they may see who have been trading crypto in the past. Complex crypto-calculations made easy.

- Bookkeeping management for all clients

- ATO ready tax reports

- Accountant dedicated support