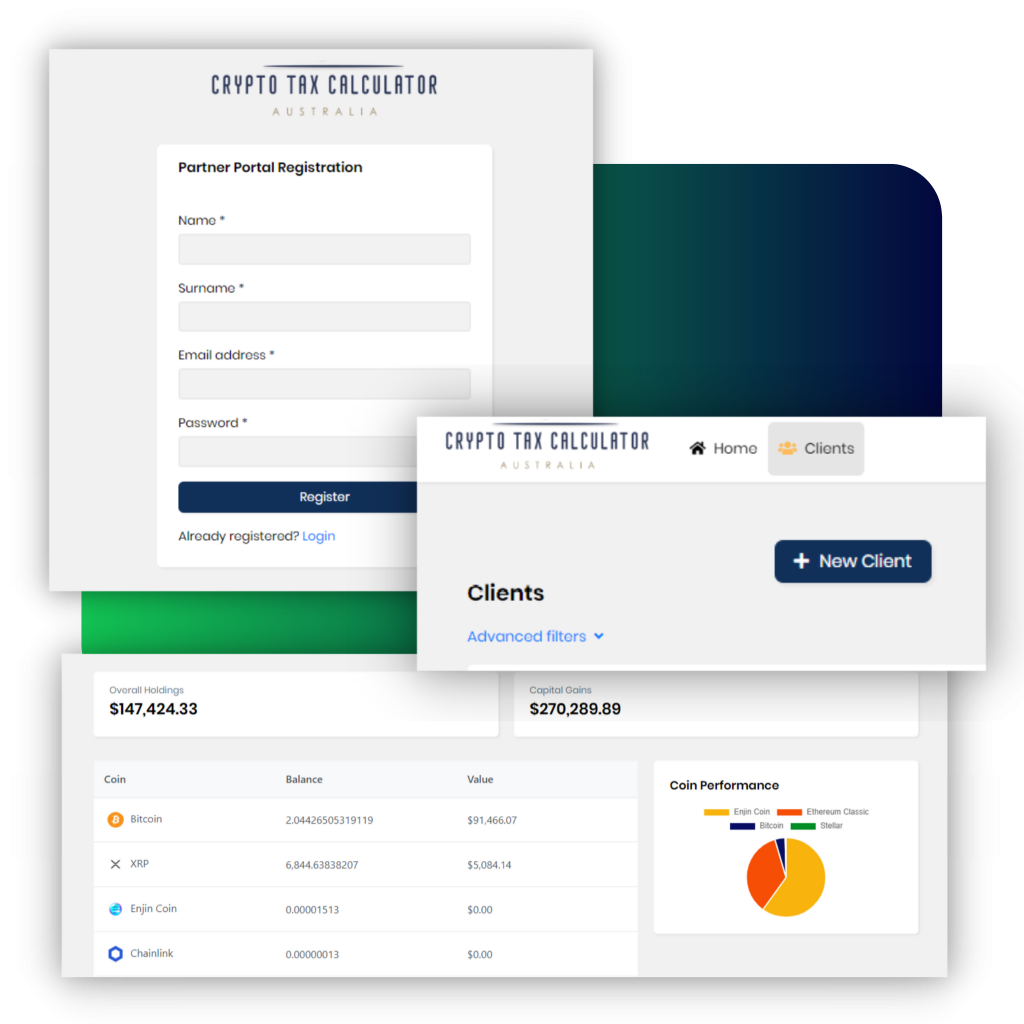

Easily calculate your client's crypto tax

We do the work so you don’t have to

We are here to support all accountants Australia wide with any clients they may see who have been trading crypto in the past. Complex crypto-calculations made easy.

- Bookkeeping management for all clients

- ATO ready tax reports

- Accountant dedicated support